A more technical look at the markets from InterTrader

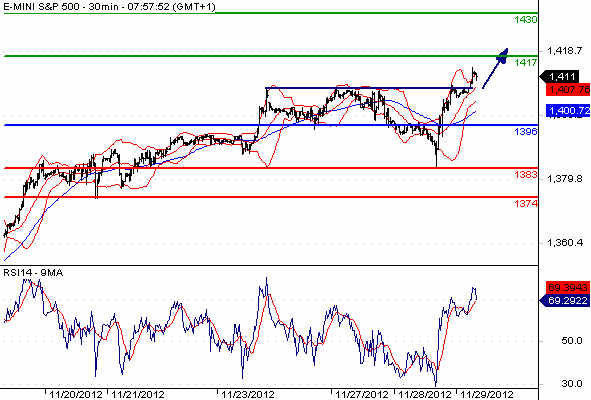

The S&P 500 pushed as low as 1383 on Wednesday in a flurry of selling, before managing to eradicate all of the losses and close in positive territory.

The index is firmly back above 1400 and has been rallying throughout this morning taking it to 1416, at the time of writing.

From a fundamental point of view, the spread betting indices are likely to remain confident following Obama’s remarks that a resolution of the fiscal cliff could be reached before the countdown expires. This comes amidst the lack of any detail backing such optimism.

Moreover, it indicates that in spite of the headwinds, there is a degree of risk appetite with the bulls now focusing on the near-term resistance at 1430.

S&P 500 Technical Chart

An upside penetration of that area would expose October’s highs at 1462. As long as the support at 1396 remains intact, there is no need for the bulls to worry.

Economic data starts to pick up again today with the US GDP and US Jobless Claims among the most notable.

Good luck

Dafni Sedari

(Original article written 29 November 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.