A more technical look at the markets from InterTrader

With the amount of QE that had been priced in ahead of September’s FOMC meeting, the only way for the Fed to please the markets, was to take a step further and do something unheard of.

And it did.

The Fed’s new policy is unprecedented in three ways;

- It is open-ended

- It is targeted at the labour market

- It is not tied to new weakness.

The explicit link between quantitative easing and jobs has never been seen by the Fed, let alone by any other central bank.

Last but not least, the Fed avoided the downbeat note by suggesting that the policy is not based on a dark outlook for the economy, but rather on the desire to improve faster.

Financial spread betting markets received the news very well, with silver and gold spread betting markets the biggest winners and the Dow and the S&P 500 reaching new highs.

There is no doubt that this is a whole new era. Thus, it is worth taking a look at the numbers to figure out what the implications could be in the gold futures market.

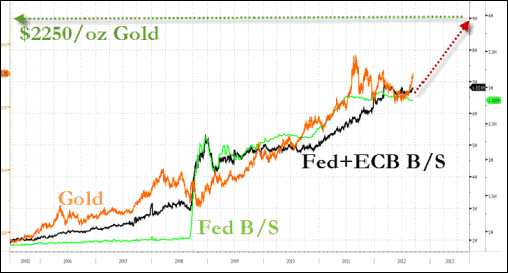

Gold, Fed and ECB Chart by Zerohedge

(For the sake of clarity we have added a second gold chart.)

Gold Spread Betting Chart 2003 to 2012

Analysis of the charts show the Fed balance sheet is likely to grow to over $4 trillion by the end of the 2013.

Looking back to QE2, gold had priced in all the Fed balance sheet expansion within six months from Jackson Hole.

This suggests the gold spread betting market could reach $2,250 around the end of the Q1 next year.

Good luck and happy trading

Dafni Sedari, InterTrader

(Original article written 14 September 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.