A more technical look at the markets from InterTrader

After a week of heavy losses for the S&P 500, it looks like there’s an increase in risk appetite at the start of the new trading week.

The vaguely promising meeting between Obama and congressional leaders on Friday buoyed hopes for a compromise over how to solve the problem of the US fiscal cliff. That has sent the S&P 500 higher.

At the time of writing the S&P is at 1368 and remains in undecided territory. This could be seen as a technical rebound in a bearish trend.

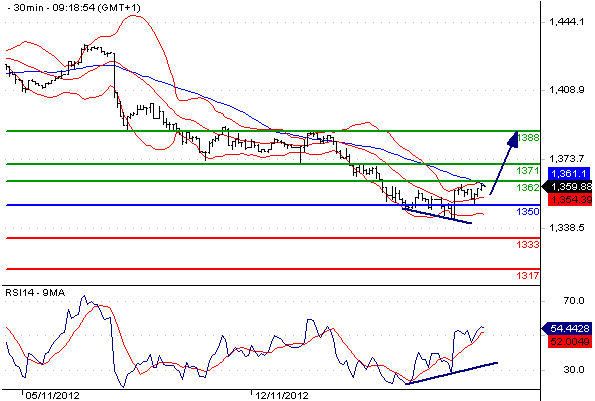

S&P 500 Chart

With the RSI posting a bullish divergence, the bulls will focus on resistance at 1371. A break above that area would expose the 1388 level.

As long as key support at 1350 remains intact the market is unlikely to resume the downward trend. A break below that area would open the door for 1333.

On the economic front, October’s US Existing Home Sales data headlines the quiet economic calendar today. Provided there are no sharp deviations from market expectations, the release is unlikely to have a directional impact on the US Index.

Good luck

Dafni Sedari

(Original article written 19 November 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.