A more technical look at the markets from InterTrader

Today’s decline in the EUR/USD spread betting market has seen a loss of about 60 points from the open. At the time of writing, the market is trading at $1.2867.

Returning to the trading floor after the Hurricane Sandy closure, US FX trading investors are creating a sense of “catch up” as markets prepare for the release of the highly anticipated non-farm payrolls (NFP).

The jobs data is expected to set the tone for today’s trading and is most significant due to its level of surprise ahead of the US Presidential elections next week.

Thursday’s upbeat ADP figure may not be as reliable as the advanced look into today’s data. This is especially true if one takes into account the fact that last month’s ADP figures were revised downwards from 162k to 88k.

However, considering the correlation between the Philly Fed employment sub-index and the Chicago Fed employment sub-index, we could see the NFP surprise to the downside. In this event, risk appetite is likely to increase.

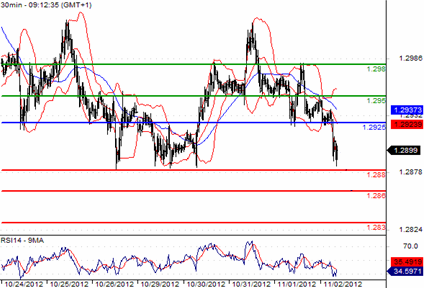

EUR/USD Chart

Observing the candlestick chart above, we can see that, for the EUR/USD pair, a break above $1.2925 could see it target the $1.298 level.

Alternatively, the penetration of the strong support at $1.286, which the pair is currently challenging, could see a move towards the next support level around $1.283.

Good luck and happy trading

Dafni Sedari, InterTrader

(Original article written 02 November 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.