A more technical look at the markets from InterTrader

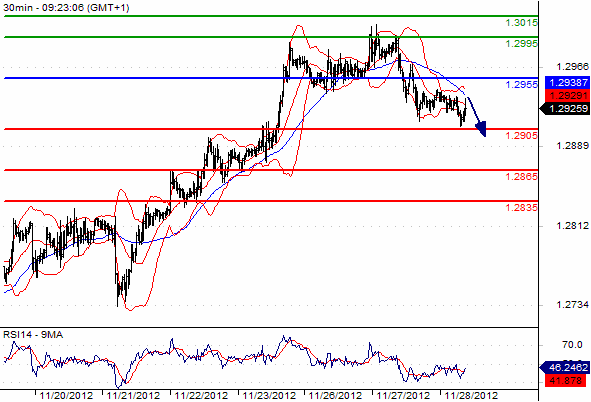

After the steps taken by the Eurogroup to ease the immediate financial burden on Greece, the EUR/USD marked a failed break of $1.3000.

As shown on the daily chart, this morning the pair fell below the bottom of the hammer that formed on Tuesday. This has confirmed the bearish outlook in the market.

EUR/USD Daily Chart

From a fundamental point of view, the negative response to a positive outcome is a further sign that the FX trading market could be set to tumble. As long as the strong resistance at the $1.3000 area remains in place, the bears look likely to continue to have the upper hand.

At $1.2930, at the time of writing, the selling pressure on the single currency could drag the pair lower to the next short-term support level at $1.2905.

A downside penetration of that area would expose $1.2865 and $1.28335. Although it is hard to imagine a bullish scenario, only a break above $1.3015 could delay the downside movement.

The focus of today’s trade during European hours will be on the German CPI due for release at 13.00 GMT. Later today eyes will be on the US New Home Sales data.

Good luck

Dafni Sedari

(Original article written 26 November 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.