- What is a Gap?

- Why Do Markets Gap?

- Losing: Being on the Wrong Side of a Gap

- When Popular Markets Gap

- How Illiquid Markets Gap

- Protecting Your Trades from Gapping

- Guaranteed Stop Loss

What is a Gap?

Below, Dominic Picarda uses C&C Group to look at what might be considerd the most important rule of investment.When a market is rising or falling, it doesn’t necessarily pay a visit to every single price-point along the way.

Sometimes, a market will leap or plunge straight from one level to another, without pausing for breath.

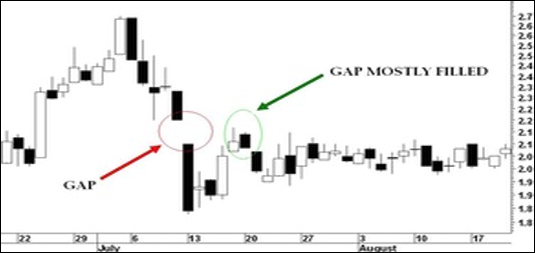

As an example, let’s look at C&C Group’s share price chart below. On 12 July, it closed at €2.20 and opened the next day at €2.10.

This left a big, empty space in between the two prices. Traders call this a “gap”, “slippage” or a “window”.

Why Do Markets Gap?

A market will tend to gap up or down when an important piece of news takes traders by surprise.In the case of C&C, the maker of Magners’ cider admitted on the day in question that it had previously overstated how well its business was doing.

The market adjusted to this nasty shock by marking down C&C’s share price sharply.

Just as nature abhors a vacuum, charting theory says that a gap always gets filled eventually. So, a price that has gapped through a particular area will almost always return to this zone sooner or later.

C&C did exactly that four days after the gap was created, with the price mostly filling its gap before dropping back again. It is therefore worth paying attention to unfilled gaps when planning your trades.

Losing: Being on the Wrong Side of a Gap

Gapping markets can clearly leave you with much bigger losses than you bargained for.Say you had previously entered a “buy” trade on C&C at €2.30 and had put your stop-loss at €2.19.

When the share gapped down on 13 July, it bypassed €2.19 entirely, with its first price of the day registering at €2.10.

Rather than being stopped out for a loss of 11 points, therefore, you’d have made a more painful loss of 20 points.

The flipside is that a gapping works both ways and a market can earn you bigger than expected profits if the price gaps in your favour.

When Popular Markets Gap

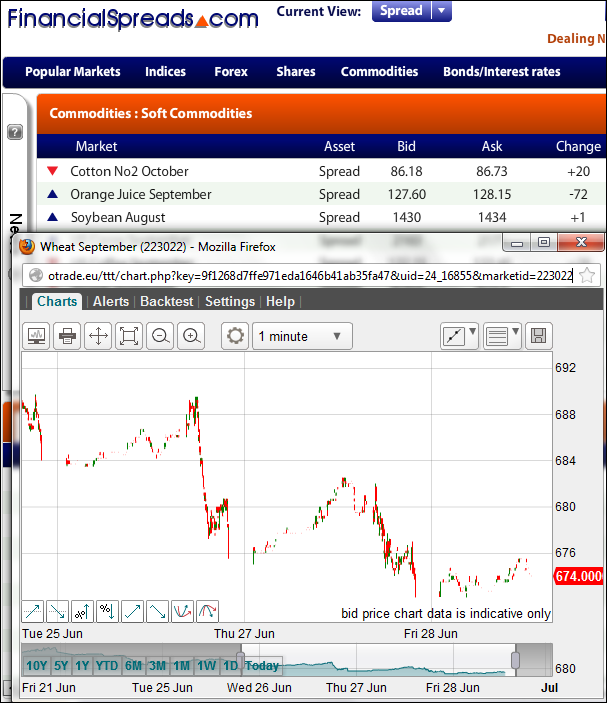

Whilst popular and liquid markets tend to gap less some of these markets, like the FTSE 100, can be traded throughout the night (Sunday evening to Friday evening).The chart below shows how, during the small hours i.e. when trading volumes are lower, even a popular market can gap. Even if, in this case, the gaps tend to be just a handful of points.

How Illiquid Markets Gap

The less popular and more illiquid markets tend to gap more. The chart below shows how wheat can constantly slip between prices

Protecting Your Trades from Gapping

You can also use Stop Losses and Guaranteed Stop Losses to protect your trades from big swings.Both types of order tell your spread betting company to close your trade if the market moves against you. For example:

You are happy to risk £200 on a Dow Jones index spread bet. So you place a spread bet, for let’s say £1 per point with a Stop Loss set so your maximum loss is £200.

This means the US index can move 200 points against your position before your trade hits your Stop Loss order and is closed

The upside with a Stop Loss order is that your trade will not be closed out if the market moves in your favour. For example, if Dow moved a lot e.g. 315 points then:

- If it moves the way you bet by 315 points then you would make a profit of 315 points x £1 per point = £315

- If it moves against the way you bet by 315 points then your trade would be Stopped at 200 points and you would only lose you 200 points x £1 per point = £200

If the market gaps through the level of your Stop Loss then it will be activated at the next traded price.

So if the market gapped by 250 points (rare but it can happen) then your Stop Loss would be triggered at 250 points so you would lose you 250 points x £1 per point = £250.

(To stop this happening, read the next section).

A Guaranteed Stop Loss is ‘Guaranteed’

Firms like FinancialSpreads, Capital Spreads and InterTrader automatically add a Stop Loss order to every trade. However you might want to protect yourself from gapping.Perhaps the US Non-Farm Payrolls are coming out and you expect the market to be volatile. Or perhaps you are keeping a trade open over a weekend and the market might gap from the Friday closing prices to the Sunday/Monday opening price (not uncommon).

In this case you could apply a Guaranteed Stop Loss to your trade.

So using the above example, if you applied the Guaranteed Stop Loss order at 200 points and the market gapped by 250 points then:

- If it market gaps the way you bet by 250 your position would be in profit by 250 points x £1 per point = £250

- If it gaps against the way you bet by 250 points then your trade would still be Stopped at 200 points and you would only lose you 200 points x £1 per point = £200

For another example see GSL example.

You can also trade through a ‘Limited Risk Spread Betting’ account where every trade has a Guaranteed Stop Loss applied to it.

Editor’s comment: The cost of having a Limited Risk Spread Betting account (i.e. a Guaranteed Stop Loss on every trade) can add up quite quickly.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.