Losses can exceed deposits

Looking at Spreadex’s Charts

For a look at how Spreadex have been developing, read on. For a full review, including user ratings and comments, see our review of Spreadex.Spreadex Launch Mobile Spread Betting App

Update 12 Oct 2011 – Spreadex has expanded its product range with the launch of a mobile spread betting app.

The app is free to download from the app store and is compatible with the iPhone, iPad and iPod Touch.

Spreadex Mobile Spread Betting

The new Spreadex spread betting app lets users:- Open, close and edit spread bets

- Set trading orders

- Access spread betting charts

- Manage their account

Spreadex Mobile Spread Betting

Spreadex Marketing Communications Manager Andy MacKenzie said: “There are many spread betting apps on the market, however we have taken the time to make sure our app operates smoothly and safely and is as straightforward as possible for investors to use.“The recent market volatility has highlighted how important it is for spread bettors to be in control of their trading wherever they are.

“This app allows clients to manage their account from their phone while on the go.” The iPhone spread betting app is also fully customisable and lets investors create their own watchlists or shortcuts to markets they are interested in.

For those who are keen on day trading or share trading, the app allows clients to view market movements on the day in either percentage or points terms.

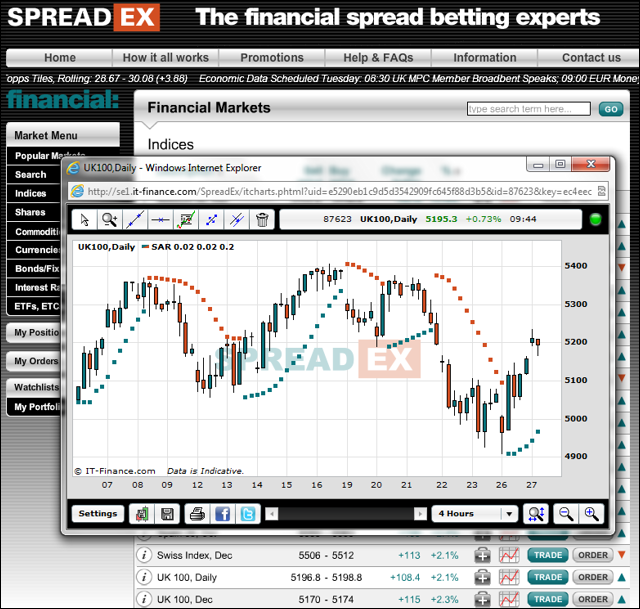

Spreadex Upgrades Award Winning Charts

Update 28 Sep 2011 – Spreadex has upgraded its award winning charting package, giving spread bettors even greater control over their trading.During the summer, Spreadex was named Best Online Charts Provider at the 2011 MoneyAM Online Finance Awards. However, the spread betting company has now improved its charting tool further. New features include:

- ProTrendLines, which automatically plots trendlines to show key support and resistance levels, Moving Averages and other important data

- 26 technical indicators with customisable parameters

- Volume indicators for shares

- The ability to share charts on Twitter and Facebook

Andy MacKenzie said:

Spread betting is often based on careful analysis and planning so a powerful and accurate charting package is a must for any serious trader.

Even though the Spreadex charts won an award earlier this year, we’re keen to make the charting tool even better for day traders, forex traders and share traders alike.

The automated trendline tool is a great way for financial spread betting investors to save time when studying a particular market’s direction and in planning potential entry and exit points.

And the option to publish chart patterns on Facebook and Twitter also allows investors the chance to share their views on where a particular market may be heading.

More Indices and Tighter FX Spreads

Update 1 Mar 2011 – Due to high demand for trading indices, Spreadex has launched five new indices markets to trade.- Portugal 20 (PSI 20)

- Netherlands 25 (AEX 25)

- Belgium 20 (BEL 20)

- Germany Tech (TecDAX)

- Spain 35 (IBEX 35)

Further to the introduction of the above indices, Spreadex has also cut the minimum stake sizes for a number of its currency markets.

It is now possible to trade over 10 separate currency pairings from 10p a point.

Spreadex Provides Daily Futures

Update 1 Jul 2011 – Spreadex has expanded its range of spread betting prices with the introduction of new Daily Futures markets.The new markets cover commodities and indices. This also means reduced spreads for investors on Brent Crude Oil, Light Crude Oil and Gold.

Andy MacKenzie said:

We have been working hard to also increase the range of financial markets available to our customers. Spreadex launched a selection of Exchange Traded Funds earlier in the year which have been very well received. We are now pleased to offer a series of Daily Futures spread betting markets.

These markets cover commodities and stock market indices. Essentially this means a reduction in the spread widths on some of the most popular markets.

Our spread betting clients can now trade Gold Daily Futures with a 0.7 spread. They can also spread bet on Light Crude Oil and Brent Crude Oil Daily Futures with a 6 point spread.

New Exchange Traded Funds for Spread Betting

Update 1 May 2010 – Spreadex have expanded their of spread betting markets to include Exchange Traded Funds (ETFs).The new ETFs include:

- Ishares AEX Tracker

- Ishares China 25 Tracker

- Ishares Emerging Markets

- Ishares FTSE 100 Tracker

- Ishares FTSE 250 Tracker

- Ishares Dow Jones Real Estate

- Ishares Russell 2000

- Irish Top 20 Tracker

In addition to the above listed ETFs, Spreadex can quote others that you are interested in spread betting on. Please call the Spreadex trading room, 08000 526 570, and they will strive to accommodate your request.

Guaranteed Stop Losses

As well as adding extra markets, Spreadex have also expanded their range of guaranteed stop losses to cover trading in currencies and commodities.In addition to the improved guaranteed stop losses Spreadex have shortened their minimum stop loss distances and NTR multipliers for certain markets. For further details see the Spreadex Market Information Sheet.

New Small Caps Spread Betting Markets

Update 5 Apr 2010 – In spread betting the most popular bets are the majors indices and the major forex markets. However if you already offer these and many other markets what do you do?Spreadex have come up with one answer.

They have expanded their AIM stock financial trading provision by listing an extra 300 small caps on their website.

The spread betting firm will now be trading small caps starting from a market cap as low as £1million and at margin rates starting from 20% of nominal share value.

Spokesman Andy MacKenzie said:

We took this step to help individuals who wish to speculate on the share price movement of companies outside the FTSE 350.

Traditionally these types of companies have been very difficult for spread bettors to trade. Many firms do not offer spreads due to the illiquid nature of some of the stocks.

When spreads can be obtained, often the amount of capital that you need pay upfront to place a bet can be prohibitive.

We are trying to improve this situation for those who have an interest in the performance of these smaller firms.

A long list of spread bets on these smaller companies has been added to our existing equities prices. However, if there are firms not listed that clients wish to trade, we urge them to call our financial room on 08000 526 570. We will do our best to accommodate their requests.

Some of the new markets include:

- Angel Mining

- Ariana Resources

- Beowulf Mining

- Carlton Resources

- Formjet

- Motive Television

- Serabi Mining

- Timestrip

Creating a Spreadex Watchlist

If there is a specific set of markets that you want to keep an eye on, you can create your own watchlist. Here is a quick video on how to create a watchlist:How to Add Stops and Limits Orders to a Trade with Spreadex

A short video on adding orders such as Stops and Limits to a trade. Viewers should note that Stops are not guaranteed but, for a small fee, you can guarantee a Stop.How to Place an ‘Order to Open’ with Spreadex

A quick video guide to placing an order to open, i.e. a trade that automatically opens when your chosen market hits a certain level.There are more video guides to using the Spreadex platform on the Spreadex website itself.

Using the Spreadex Platform

For more videos on using the Spreadex platform, see:

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.